One simplistic way is to put your money where your probabilities are. If you think there is a 70% chance the market will go down and a 30% chance the market will go up further, then buy the market. However, if it goes up, how much will it go up, or how much will it go down? If your answer is, it could go down 14% or up 3%:

Probability times percentage rise or drop.

.70 X (-20) = -14%

.30 X (+10) = + 3%

Then, look elsewhere. For example, a high grade corporate bond ETF yielding 5% with a duration of 6 years. Now, for every 1% decline you would make a 6% capital gains while collecting a yield of 5%, for a total return of 11%.

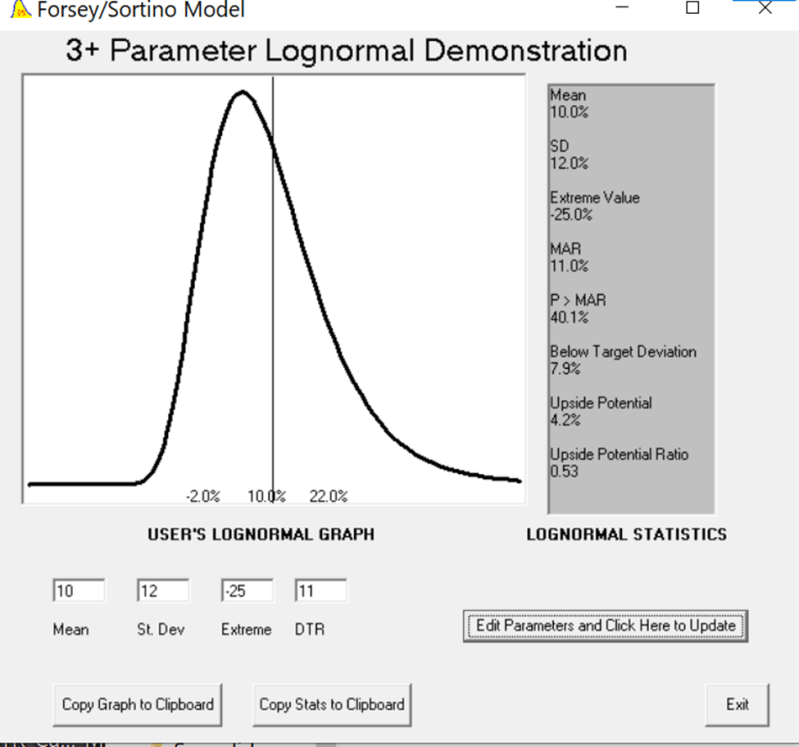

I do not think probabilities capture downside deviations as a measure of risk and I do not think probabilities capture the upside potential. So, I will use the Forsey-Sortino model we gave away in our last book to compare the stock market with the intermediate term bond market.

Now, given that I have a high probability of earning 11% over the next year, what could I get investing in the stock market, assuming a 10% expected return above the market price on SPY on 2/12/2024 and a standard deviation of 12%. The FS model indicates an upside potential of 4.2% above the 10% expected return, or 14.2%. Clearly, 14.2% beats 11%. However, we also see that the downside risk is 7.9%. Therefore, the upside potential ratio of 4.2/7.9 = .53, meaning, The stock market has 67% more downside risk than upside potential. Does this change your mind about jumping into the market at this all time high? That return of 11% is not guaranteed. It is subject to interest rate risk. Hmmm, how do we calculate the interest rate risk? I leave that to you.

I have made my decision.